GET IN TOUCH >>

REQUEST A CALLBACK

Welcome to your professional, approachable and jargon-free mortgage and protection specialists.

We are able to advise in the following areas...

Property Purchases Re-mortgages Buy To Let Bridging Finance Later Life Lending First Time Buyers Flexible Mortgages Help to Buy Offset Mortgages Self Build Mortgages

Life Insurance

Critical Illness Insurance

Income Protection Insurance

General Insurance

Home & Contents Insurance

Key Person Insurance

Partnership Protection

Relevant Life Plans

Shareholder Protection

Product Transfers

We also have trusted referral partners able to place second charge loans and equity release.

YOUR PROPERTY MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON A MORTGAGE OR ANY OTHER DEBT SECURED ON IT.

Please note: Ian Stuart Mortgages Limited is a credit broker not a lender.

Some Buy to Let mortgages and Bridging Finance are not regulated by the Financial Conduct Authority.

You will need to take legal advice before releasing equity from your home as Lifetime Mortgages and Home Reversion plans are not right for everyone. This is a referral service.

Do you want to reduce your current mortgage outlay or are you moving home? How much cash would your family need to maintain their current lifestyle?

For most people, buying a house is the biggest financial decision they will make in life. We understand this, we are experts in guiding our clients through the often complex process of securing the funding they need to buy the home of their dreams, and we specialise in finding mortgages for people who have challenging financial circumstances.

Take a look through our website and then please get in touch. We're happy to help!

Mortgages

There's a wide range of mortgage products out there, with varying interest rates and repayment options available.

Insurance

We provide a wide range of insurance products and services, as a complement to our mortgage offerings.

Our Team

Our people are very important to us, as is making certain we provide the best possible professional financial advice.

News & Blogs

Here are some news articles related to the UK mortgage industry, together with some useful tips and insights...

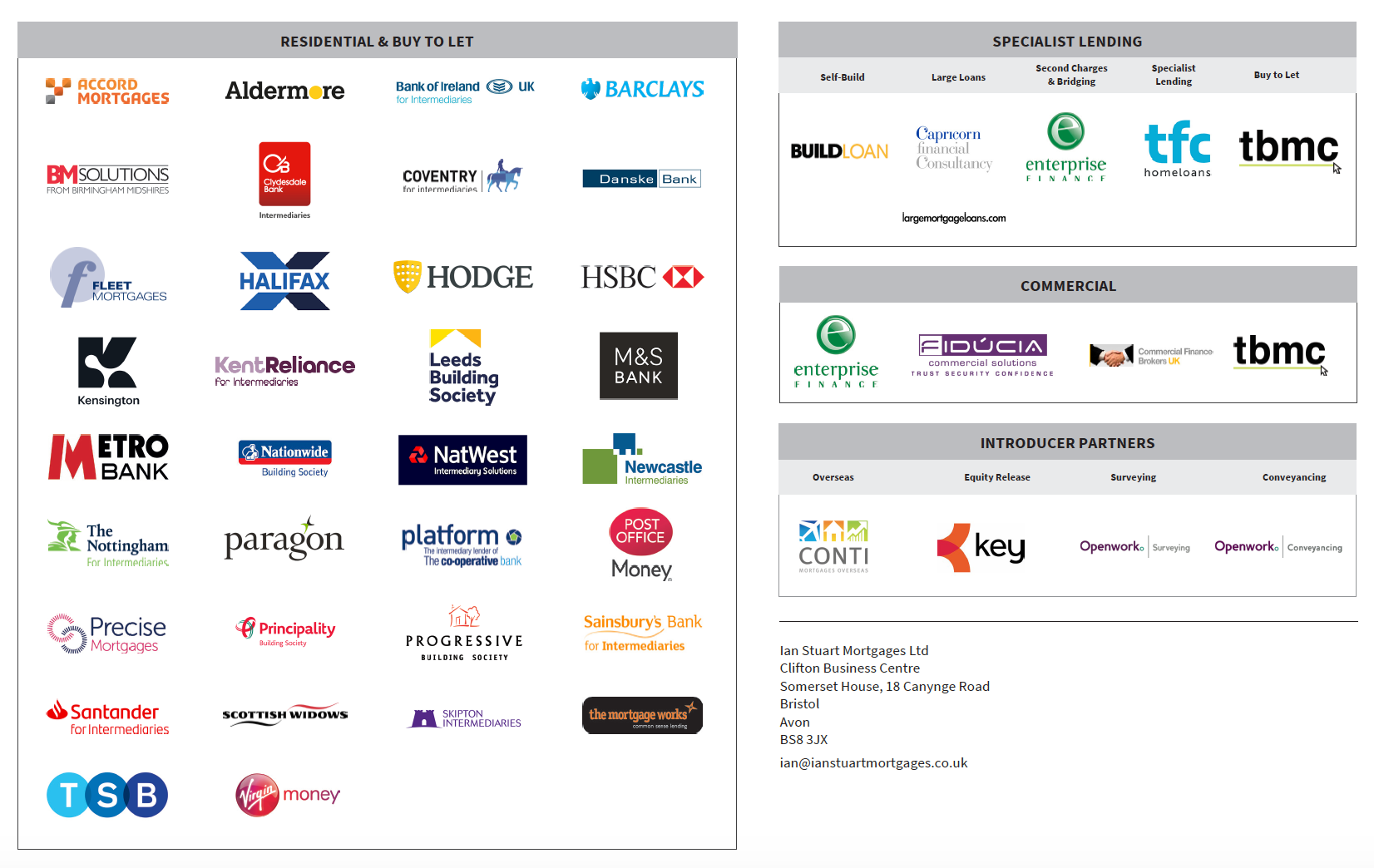

Our Lenders

As a representative of Openwork, one of the UK's largest financial advice networks, we can recommend mortgages from a wide choice of well-known lenders and specialists.

How we work

Getting to know you

We will want to learn more about you, your circumstances, and your overall financial position. We’ll also want to hear your thoughts on which type of mortgage you believe is right for you, before we talk you through the pros and cons of each option.

What we must tell you

When you first speak to us, we have to tell you what our charges are and how they are paid. We also have to say if there are any limits to the range of mortgages we can recommend for you.

Researching the options

Using our expert knowledge and database of several thousand mortgages, we will find the ones that are most suitable for your needs.

Recommending the right solution

Once we have identified the options available, we’ll meet with you again or discuss our recommendations over the phone. We’ll also write to you so you can review what we have suggested, and why.

Assuming you’re happy with our recommendation, we’ll work with you to complete the application forms and liaise on your behalf with solicitors, valuers and surveyors. We can also talk you through the vital areas of financially protecting your new property and we’ll stay in touch throughout the process – and into the future.